Governmental initiatives aimed at fostering citizen welfare and economic empowerment are a cornerstone of governance. Uttar Pradesh takes a proactive step in this direction with the launch of the UP MSME Loan Fair, focusing on extending financial assistance and social security. To facilitate easy access and participation, a dedicated mobile application and portal have been introduced as part of this initiative.

Registering on the official website of the scheme is the first step towards availing its benefits. Through today’s article, we endeavor to furnish you with a comprehensive understanding of the UP MSME Loan Fair, covering all pertinent information. It’s imperative to read the article through to the end for a thorough grasp of the subject matter.

What is UP MSME Loan Fair?

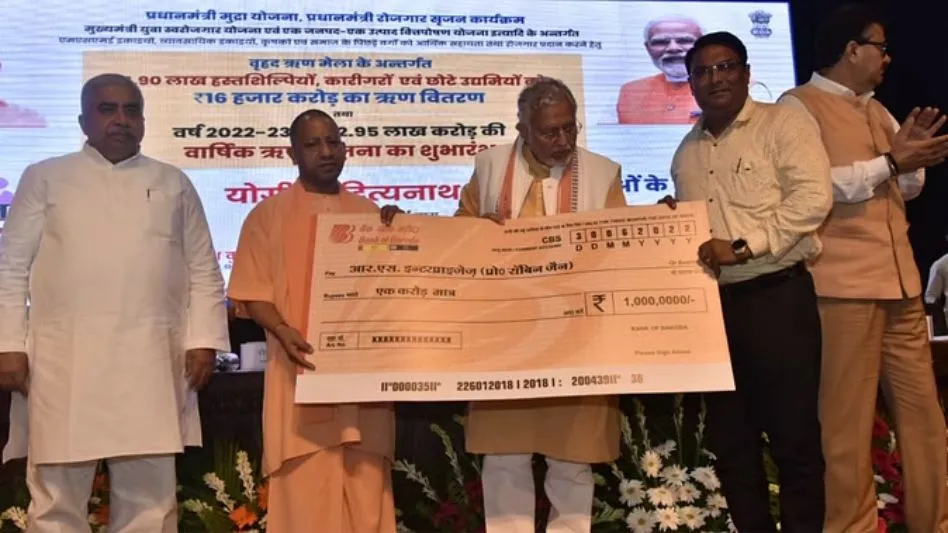

To extend financial aid to the state’s entrepreneurs and facilitate enterprise expansion, the government has initiated the UP MSME Loan Fair. Allocating a loan corpus of 2000 crore rupees, the government aims to benefit 36,000 enterprises in Uttar Pradesh on the opening day of applications. Micro, Small, and Medium Enterprises (MSMEs) are the lifeline of the economy, and their strength is pivotal for business viability. Therefore, the government will provide financial assistance to fortify them. If you’re a resident of Uttar Pradesh seeking to leverage the benefits of this scheme, registering on the UP MSME Loan Fair portal is essential. In this article, we’ll walk you through the registration process.

UP MSME Loan Fair Details

| Scheme Name | UP MSME Loan Mela |

|---|---|

| Launched By | Uttar Pradesh Chief Minister Yogi Adityanath |

| Beneficiary | MSME Sector |

| Total Budget | ₹2000 Crore |

| Registration Process | Online |

| Application Dates | May 14th to May 20th |

| Official Website | https://diupmsme.upsdc.gov.in/ |

UP MSME Loan Mela Scheme Purpose

The primary objective of this scheme is to foster the growth of micro, small, and medium enterprises (MSMEs) and extend financial support to entrepreneurs by making loans accessible. By fortifying the industrial sector, the scheme aims to enhance employment opportunities, thereby benefiting the working class.

UP MSME Loan Mela Scheme Features

- The Uttar Pradesh MSME Loan Fair has been launched to expand the entrepreneurial sector and provide financial assistance to entrepreneurs.

- Within 24 hours of the scheme’s inception, the UP government has already launched the MSME Companion Portal and mobile app.

- Under this scheme, the UP government will provide a loan corpus of 2000 crore rupees to 56,754 entrepreneurs.

- Applications for the UP MSME Loan Fair scheme will be accepted from May 14th to May 20th.

- On the first day of the scheme, loans will be provided to 36,000 micro, small, and medium enterprises. The loan amount provided under this scheme will be disbursed through banks.

- The government has partnered with several banks to facilitate loan disbursement.

- By benefiting from this scheme, individuals’ financial problems will be alleviated, and the entrepreneurial sector will thrive.

- The UP MSME Loan Fair will promote and support micro, small, and medium enterprises.

- Through this scheme, indigenous products will be transformed into global brands.

- If any issues arise regarding payments under this scheme, individuals can file online complaints with the relevant state MSMEFCI.

- After thorough verification, payments will be made with applicable interest rates according to the provisions set by the ministry.

Types of MSME

- Companies and enterprises investing 1 crore rupees under the micro-industry sector and achieving a turnover of 5 crore rupees are included.

- Similarly, companies and enterprises investing 10 crore rupees under the small-scale industry sector and achieving a turnover of 50 crore rupees are eligible.

- Under the medium-scale industry sector, companies and enterprises investing 20 crore rupees and achieving turnovers up to 100 crore rupees are included.

Uttar Pradesh Loan Schemes

- “One District One Product Scheme” aims to promote specialized products from each district, fostering local entrepreneurship and economic growth.

- “Chief Minister’s Youth Self-Employment Scheme” is designed to empower the youth by providing them with opportunities to become self-employed and contribute to the economy.

- “Vishwakarma Labor Honor Scheme” is a program to recognize and honor the contributions of laborers, particularly those in the Vishwakarma community, to the workforce and society.

- “Prime Minister’s Employment Generation Program” focuses on creating employment opportunities by promoting entrepreneurship and facilitating the establishment of micro-enterprises.

- “Mudra Scheme” aims to provide financial assistance and support to micro-enterprises and small businesses through loans and other financial services.

UP MSME Loan Fair Eligibility Criteria

- Companies on the business blacklist should not be included in the scheme.

- Trusts, non-governmental organizations, and religious institutions will not be eligible for benefits under this scheme.

- Businesses must have been operational for a long period to qualify.

- The business’s minimum turnover should be declared above a specified threshold.

- Applicants will need to provide their Aadhaar card, email ID, bank account details, PAN card, registered mobile number, and passport-sized photograph.

UP MSME Loan Fair 2024 Schemes

- “One District, One Product Training and Tool Kit Scheme” aims to provide training and tool kits to entrepreneurs focusing on one specific product from each district, thereby fostering skill development and entrepreneurship.

- “Vishwakarma Labor Honor Scheme” is designed to honor and recognize the contributions of laborers, particularly those belonging to the Vishwakarma community, by providing them with financial assistance and other benefits.

- “One District, One Product Margin Money Scheme” aims to provide financial assistance in the form of margin money to entrepreneurs focusing on one specific product from each district, thereby supporting them in starting or expanding their businesses.

- “Chief Minister’s Youth Self-Employment Scheme” is a program aimed at empowering the youth by providing them with opportunities for self-employment and entrepreneurship through various support mechanisms and incentives.

MSME Registration online process

- Your first step is to visit the official website.

- Upon reaching the homepage, access the login tab and proceed to click on the applicant login option to log in.

- Then, select the option for new user registration.

- Following this, the online registration form for the Uttar Pradesh Loan Fair will become available.

- Fill in all the details requested in the application form, and don’t forget to upload the requisite documents.

- Finally, click on the submit button to finalize your registration.

MSME Sathi Loan App Download Process

- Begin by accessing the Google Play Store on your smartphone.

- Next, type “MSME sathiapp” into the search bar and initiate the search.

- Once the list of apps appears, locate the MSME Sathi app and click on it.

- Click on the install option to download the app.

- Following these steps, you will successfully download the MSME Sathi app.

UP MSME Mobile App Complaint Registration

- First, you need to open the MSME Sathi mobile app.

- Then, click on the menu bar options and select the option for complaint details.

- Next, you’ll need to enter the details of the complaint.

- Also, make sure to upload all the necessary documents.

- After that, you’ll need to select the category of the complaint.

- Finally, click on the submit option.

By following these steps, you will be able to register your complaint.

UP MSME Loan Fair Referral Registration Steps

- Firstly, you need to visit the official website of MSME.

- Once you are on the homepage, you’ll need to click on the option “Online Registration”.

- After that, click on the option “Enter Reference”.

- Then, you’ll need to enter your username and password.

- Next, enter the captcha code and click on the login option.

- After logging in, click on the option “Enter Reference” again and provide all the requested information.

- Finally, click on the submit option.

By following these steps, you will be able to register your reference.

UP MSME Loan Fair Reference Status Check

- To begin with, you’ll need to visit the official website.

- Once you’re on the homepage, you’ll have to click on the option for “Online Registration”.

- After that, you’ll need to click on the option for “Check Reference Status”.

- Then, you’ll have to enter your login credentials and input the reference number.

- After entering these details, you will receive the relevant information.

UP MSME Loan Fair Suggestion Submission Process

- Start by visiting the official website.

- Once you’re on the homepage, click on the option for “Online Registration”.

- Next, click on the option to “Provide Your Suggestions”.

- This will open a new page where you’ll need to enter your login credentials and click on the “Sign In” option.

- After that, you’ll be required to input all the requested information and click on the “Submit” option.

- Following these steps, you’ll be able to provide your suggestions.

UP MSME Loan Fair Suggestion Status Check

- Begin by navigating to the official website.

- Once on the homepage, click on the option for “Online Registration”.

- Next, click on the option for “Status of Suggestions”.

- This will open a new page where you’ll need to enter your username and password.

- Enter the captcha code and click on the “Sign In” option.

- After that, input the reference number, and then you’ll be able to access the relevant information.