After the bank increases the lending rates, the EMI of other loans including home loans, auto loans linked to MCLR will increase. This increase is effective from July 15, 2024.

SBI hikes lending rates: The country’s largest bank SBI has given a big shock to millions of customers on Monday (July 15) morning. SBI has increased its margin cost of funds based lending rates (MCLR) by up to 10 basis points (0.10 percent). This increase is applicable on MCLR of selected tenure. After the bank increases the lending rates, the EMI of other retail loans including home loan, auto loan linked to MCLR will increase. This increase is effective from July 15, 2024.

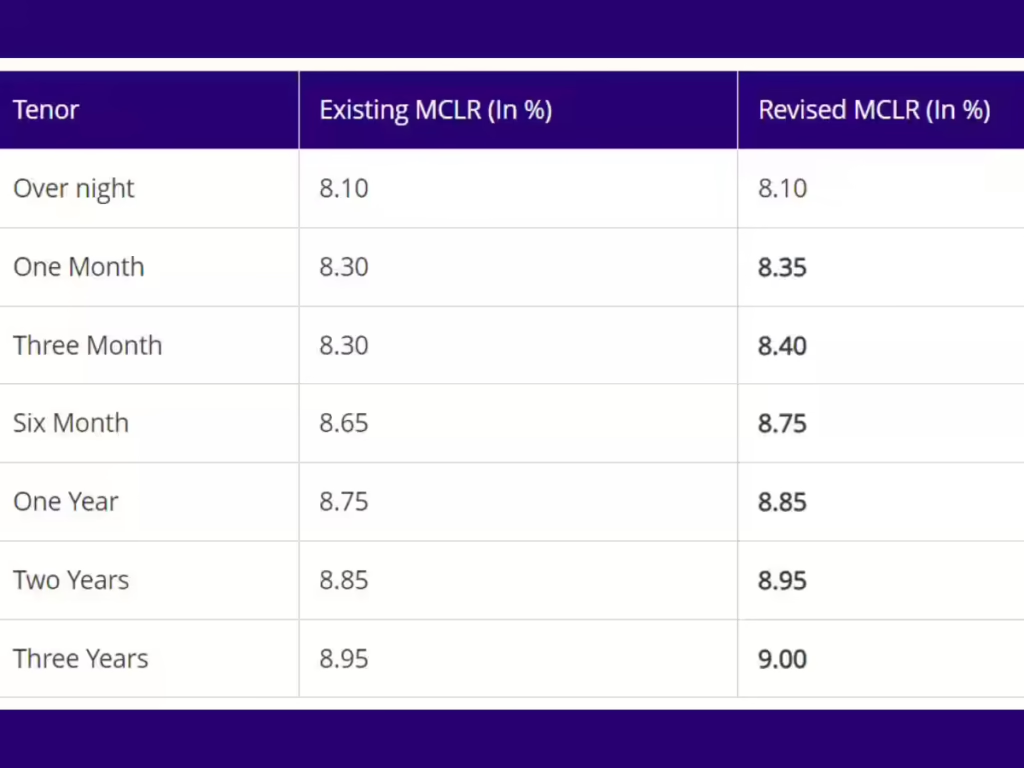

According to the information available on SBI’s website, interest rates on MCLR with tenure ranging from three months to three years have been increased by 0.10 percent. Let us tell you, MCLR is the minimum interest rate at which the bank cannot give loan. It reflects the trends of the cost of borrowing of the bank. It was introduced in 2016. The purpose of which was to fix the interest rates according to the cost of funds. So that there is transparency about the interest rates of the loan in front of the customers.

EMIs will be affected

The increase in MCLR by SBI will affect the EMI of other retail loans including home and auto loans. Actually, the repayment installment of the loan linked to MCLR will increase based on the reset period of the loan. For example, if your home loan is linked to 1 year MCLR and its reset period is near, then soon its interest rate will increase by 10 basis points. This means that you will have to pay more EMI.

SBI’s new MCLR applicable from July 15, 2024

It is worth noting here that the Reserve Bank (RBI) kept the repo rate stable at 6.5 percent in the monetary policy review of June. RBI kept the repo rate unchanged for the 8th consecutive time.

Understand the calculation on 30 lakh home loan

Suppose you have taken a loan of Rs 30 lakh for 20 years from SBI. Which is linked to 1 year MCLR. Before the increase in interest rates, the interest rate was 8.75 percent. On this basis, the EMI of your home loan was Rs 26,511. Now the interest rate has become 8.75 percent. In this way, the EMI of your home loan will increase to Rs 26,703.