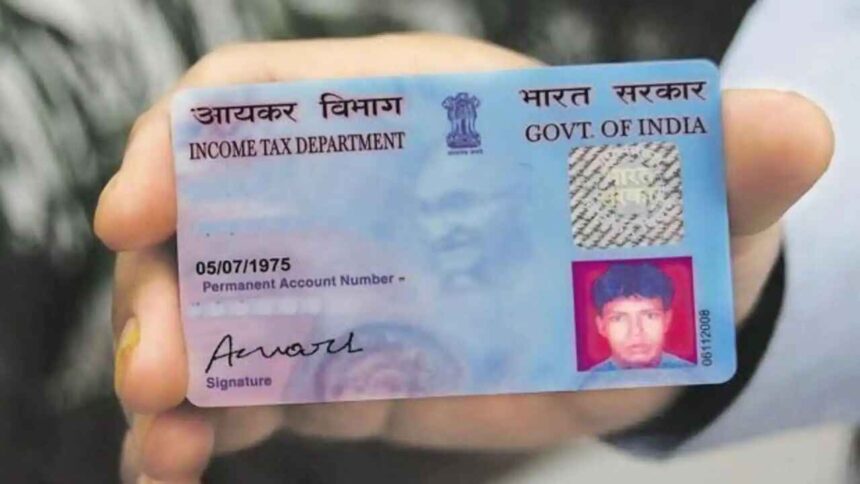

In the modern era, PAN card is a very important document, in the absence of which not only one but many tasks get stuck. If you go to open an account in a bank, then PAN card is given priority first. Not only this, if you pay TDS or tax, then also PAN card is required. Therefore, it is very important to have a PAN card.

Pan card update: If you do not have a PAN card then do not worry. We are going to tell you a method with the help of which you can get a PAN card made in just 10 minutes without any problem. You can easily get an e-PAN card made which is a very simple method. Do not delay in getting your PAN card made, because these days this service is available at every Jan Suvidha Kendra. Therefore, it is important that you first know the important things related to it.

Important things related to PAN

If you want to get a PAN card, then first you have to understand the important things, which will end all your confusion. If you want to get an e-PAN, then it is very important for you to have an Aadhaar card. Along with this, e-PAN is also as universally accepted as a regular PAN. You will need to get an e-PAN card made through Aadhaar card only.

You will have to visit https://www.incometax.gov.in/iec/foportal/ from your phone or laptop. After this you can click on the option of instant E-PAN. Here a new page will open. In this, the option of Get New e-PAN will appear on the left side. You can easily click on it. Then later you will need to enter the 12 digit Aadhaar number.

Then you will need to tick the option of I confirm that given below. After this, an OTP will be sent to the mobile number linked to your Aadhaar. After entering the OTP, you will need to enter the e-mail ID and fill the necessary information for the PAN card.

You will get your PAN number after filling the form

You will get the PAN card number shortly after filling the form. You can use the PAN number in the same way. In this way, you will have to use a regular PAN. After applying, you can download the PAN card in PDF format by clicking on the option of “Check Status/Download PAN” from this website. This will end all your confusion.