Your CIBIL report does not only contain your credit score, there are many other things in it which most people are not aware of. Know about it here.

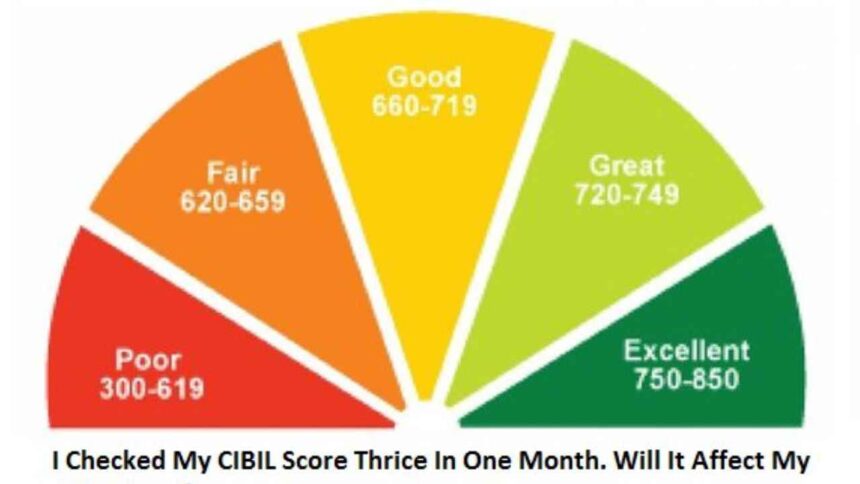

CIBIL Score Alert: CIBIL Score is a way to measure the ability to take a loan and repay it. The range of CIBIL score is between 300 to 900. The better the CIBIL score, the more reliable the person becomes for the bank. Generally, a score above 750 is considered good. Credit information companies like TransUnion CIBIL, Equifax, Experian and CRIF Highmark issue CIBIL reports from time to time. Your CIBIL report does not only contain credit score, it also contains a lot of other things, which most people are not aware of. Know about it here-

How is CIBIL report prepared

Monthly records of your loan and credit card are given to credit information companies by various institutions including banks and NBFCs. Banks and other financial institutions submit customer loan and credit card data to credit information companies on a monthly basis, based on these records these companies prepare CIBIL report.

CIBIL report contains the following information

Credit score: A 3 digit credit score between 300 and 900 is recorded in it which shows the credit worthiness of the person.

Personal information: Apart from the credit score, the person’s date of birth, PAN, mobile number, address etc. are mentioned in the first part of the CIR.

Account related information: There is information about your current loan, previous loans and credit cards, your outstanding amount, loan amount, credit card limit etc.

Credit inquiry: Whenever you apply for a credit card/loan, the loan giving institution requests the credit information company for a copy of your credit report. Such a request made by the loan giving institution is called an inquiry. This inquiry is also mentioned in the credit report.

If wrong information is recorded in the credit report…

Many times, wrong information gets recorded in the credit report due to wrong information given by banks or other financial institutions regarding loan dues. In such a situation, you can register a complaint about the matter in the bank. If the mistake is not corrected within 30 days, then the complainant is given compensation of Rs 100 per day as per the calendar day. This means that the more delayed the settlement, the higher the penalty will be.

The loan giving institution has to give this information to the credit bureau within 21 days of receiving the complaint and the credit bureau gets 9 days to correct the mistake. If the bank or the loan giving financial institution does not inform the credit bureau within 21 days, then the bank will have to pay a penalty to the complainant. On the other hand, if the bank gives the information on time, but the complaint is not settled even after 9 days, then the credit bureau will have to pay a penalty.