ITR Filing: A Delhi resident has shared his ordeal on social media regarding income tax return filing. Apoorv Jain, a resident of Delhi, said that he had to pay Rs 50,000 to a CA to resolve an income tax dispute of Rs 1. He has raised questions on the seriousness of income tax

Income Tax Notice: The deadline for filing Income Tax Return has been fixed as 31 July 2024. Income Tax is such a document. Under which the information about the income of the taxpayers during the financial year is available. If a taxpayer is unable to fill ITR, then he has to pay a fine. Many people also face difficulties in filing it. Sometimes filing tax in a hurry can also lead to a big mistake. Something similar has happened with Apoorva Jain of Delhi. The person has claimed that he had to spend Rs 50,000 to resolve the income tax dispute of Rs 1.

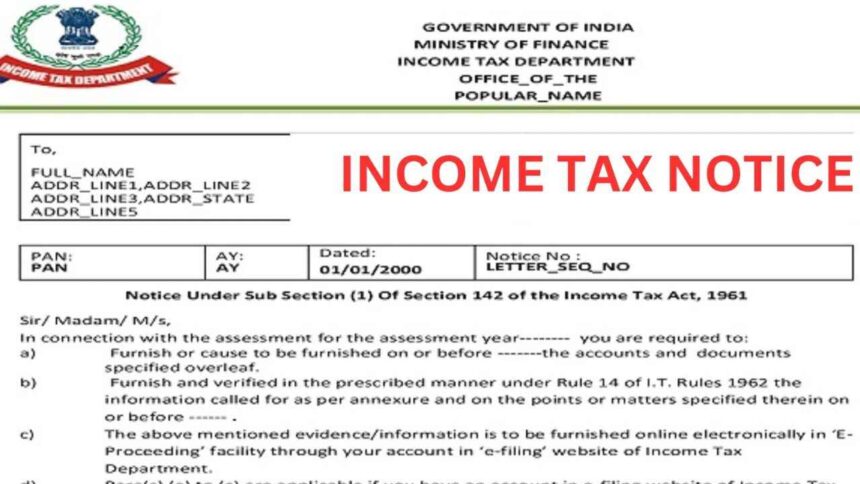

In case of any error in filing income tax return, a notice is sent to the taxpayers by the department. This is the reason why taxpayers are advised to file returns carefully. A story related to tax is going viral on social media. It has been shared by the concerned taxpayer himself. He has expressed his strong displeasure with the Income Tax Department regarding this matter.

Got notice from income tax for 1 rupee.

Actually, a person named Apoorv Jain has claimed on social media that the Income Tax Department has sent him a notice for Rs 1. In this post, Apoorv has said that imposing tax on PF interest is a severe blow to the employed. After this, many difficulties have to be faced. EPFO pays interest every time after the deadline of ITR is over. Due to which taxpayers take a day off from work to calculate tax. After this, if any mistake is made even unknowingly, then one has to suffer a lot and the Income Tax Department sends a notice.

50,000 rupees were given to the CA, then the matter was settled

Apoorv hired a chartered accountant (CA) to solve the matter. He gave him 50,000 rupees. Later it was found out that there was a difference of 1 rupee in the calculation. This means that to solve a tax dispute of just 1 rupee, he had to pay 50,000 rupees. Apoorv has expressed his displeasure with the department and has appealed for improvement in the working system. He has also expressed displeasure with the working methods of the Income Tax department.