If you take a home loan or any other home-related loan from State Bank (SBI Home Loan), then on what CIBIL score can you get a loan at what expensive or cheap interest rate? Know how your CIBIL score is prepared.

SBI Home Loan Interest Rate: We all know how important it is to have a good CIBIL score to get a loan. In today’s time, most people fulfill their needs by taking loans. While taking a loan, banks determine whether you should be given a loan or not only after looking at your CIBIL score. If you have to give the loan, then what interest rates should be charged.

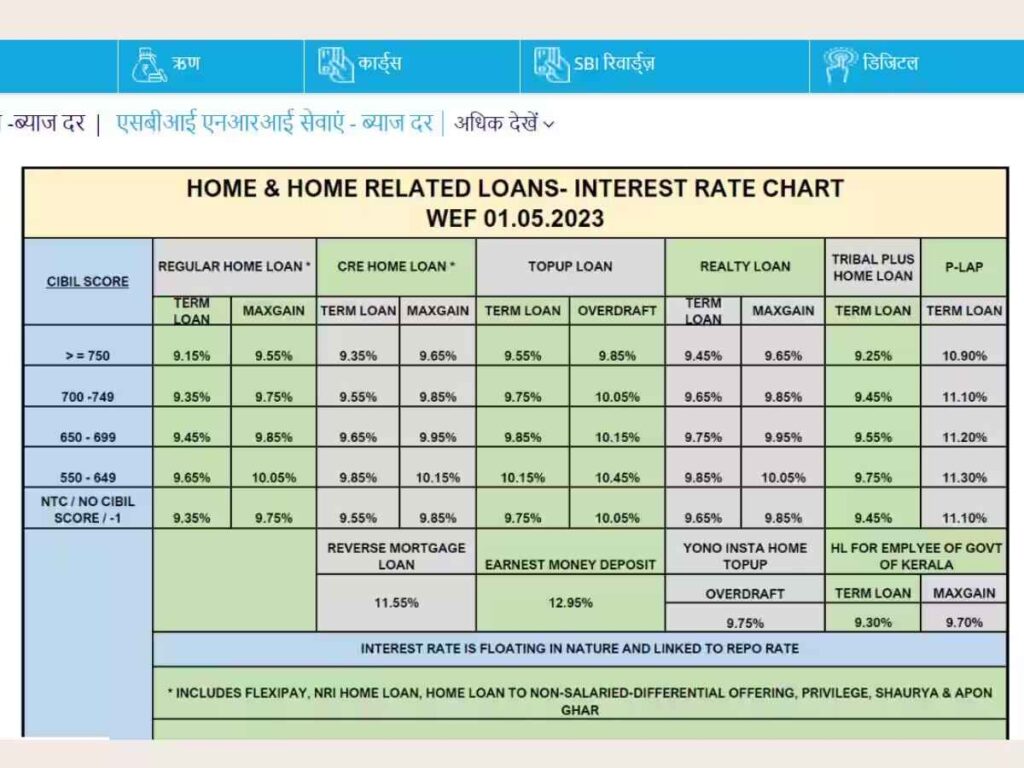

Let us tell you that the CIBIL score is between 300 to 900. CIBIL score is also called Credit Score. The higher the credit score, the more reliable the bank considers you as a customer. In such a situation, the loan is easily available and comes with a low interest rate. On the other hand, if the CIBIL score is low, then it becomes difficult to get a loan and even if you get it, the interest rate is very high. Let us tell you that if you take a home loan or any other home related loan from State Bank (SBI Home Loan), then on what CIBIL score can you get a loan at how expensive or cheap interest?

SBI Home Loan or Home Related Loan Chart

How is credit score determined?

Many factors work to determine the credit score such as loan repayment history, credit history, credit utilization ratio and credit mix etc. Apart from these, your CIBIL score is calculated from some other things like wrong information in your credit report, you have ever done loan settlement before, you are a guarantor for someone’s loan and it is not being paid etc. All these also affect your CIBIL score and this can spoil your score.

Who prepares the CIBIL score?

Many credit bureaus issue CIBIL score. Among these, credit information companies like TransUnion CIBIL, Equifax, Experian and CRIF Highmark are considered prominent, these companies are licensed to collect financial records of people, maintain it and generate credit report / credit score based on this data. These credit bureaus evaluate the customer data deposited with banks and other financial institutions such as outstanding loan amount, repayment records, applications for new loan / credit card and other credit related information etc. and prepare the CIBIL score based on that.